Piecemeal Distribution Of Cash Problems With Solutions - Important information and a detailed explanation about PDF ePub eBook piecemeal distribution of cash problems with solutions its contents of the package names of things and what they do setup and operation. 2 Maximum PossibleNotional Loss Method.

Distribution Of Cash Among Partner

XY and Z were partners sharing profits and losses in the ration 321.

Piecemeal distribution of cash problems with solutions. These are the methods of distributing cash in piecemeal namely. 17 Most Common Procurement Problems. Surplus or Excess Capital Method.

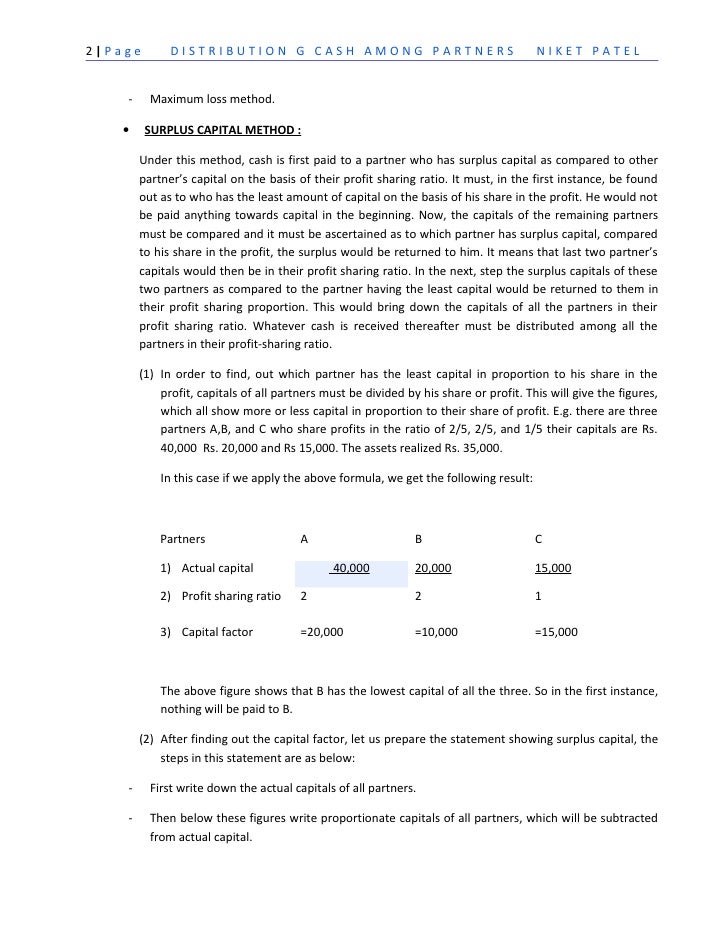

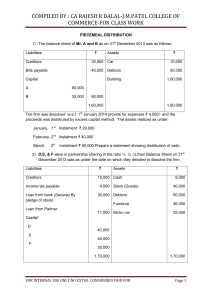

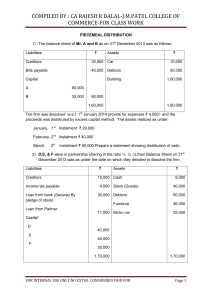

Under this method the excess capital contribution by the partners with reference to their profit sharing ratio is determined. Piecemeal Distribution of Cash on Dissolution 2. March 05 2011 025718 PM The following is the balance sheet ofxyz ho share profits in the ratio of 431 on 112006 on which date they dissolve patnership.

MEANING OF PIECEMEAL DISTRIBUTION OF CASH. Piecemeal distribution calculate surplus capital on. 31st December 31st March As Capital Account Cr Additional Adjustment Advance amount Answer Assets Bad Debts Balance bd Balance Sheet Bank AC basis Bills Receivable Book Book Value Building Calculation Capital AC Capital Accounts Cash AC Cash Book Cash in hand charged cheque Closing Stock Club cost Creditors Current customers Date Particulars debit Debtors Depreciation Depreciation.

Exam MFE questions and solutions from May 2007 and May 2009. 1 Allowing Poor Quality for Lower Costs. Cs capital is Rs 28000 hence the proportionate capitals of A and B are Rs 56000 each.

Dissolution expense were originally provided for at an estimated amount of Rs5000 The actual expenses amounted to Rs3000 spent on 31st March 2012. They decided to set aside 22000 to meet realisation expenses and to distribute the proceeds by sale of assets. Piecemeal Distribution o Multiple Choice Questions Option - A Option - B For finding unit value capital is divided by Profit Sharing Ratio Capital Ratio Which is lowest Which is highest Unit value we multiply with each ones Profit Sharing Ratio Capital Ratio Secured Unsecured East West Realisation of assets on dissolution is Sudden Gradual External liabilities are liabilities due to Partners Creditors.

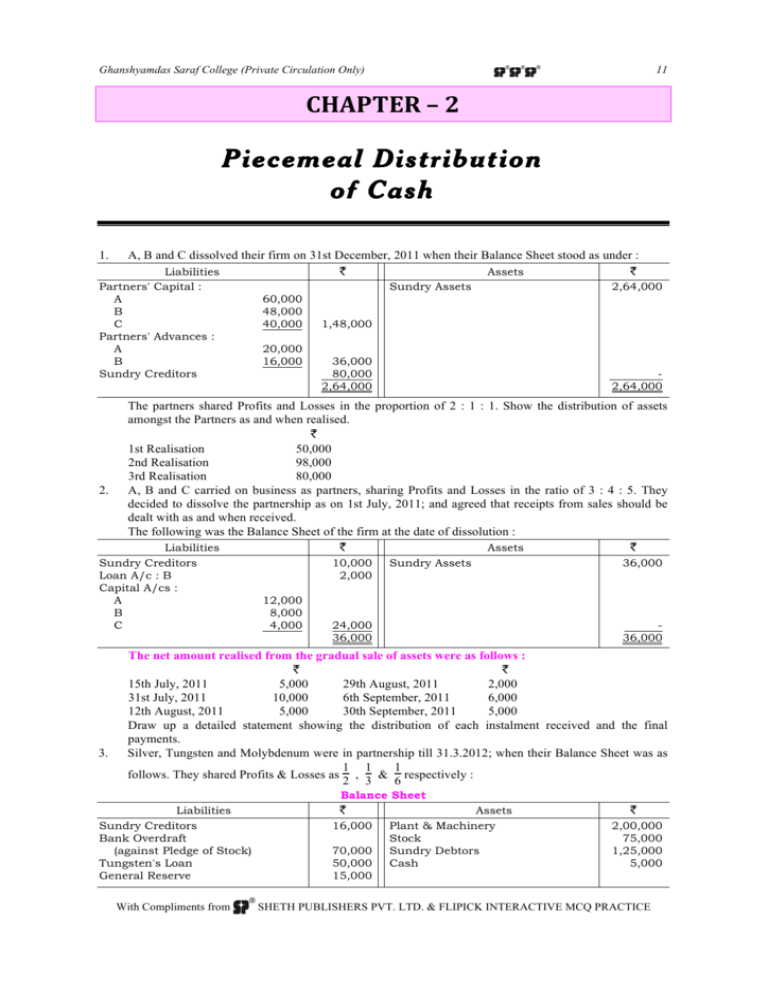

Problems and Solution PIECEMEAL PAYMENTS Generally the assets sold upon dissolution of partnership are realised only in small instalments over a period of time. They requested their accountant to prepare a cash budget for the four months ending 30 April 2016. Cash available for distribution amongst the partners cannot be distributed according to the profit and loss sharing ratio unless the capitals of the partners are in the profit and loss sharing 1st Realisation 40000 ratio because that will not leave the unpaid balances of the capital accounts in the profit and 2nd.

They are released over a period of time depending on the conditions of the market. You are required to prepare Realisation account Capital accounts and A B C private limiteds account in the books of the firm assuming that all the transactions are duly completed. View Problems sheet for Piecemeal Distribution of cash_24909pdf from ACCT 2336 at DEWA Islamabad Campus.

Insolvency of Partner 3. It was agreed that cash should be distributed as and when realized. In this version standard normal distribution values are obtained by using the.

So on dissolution of the firm cash is to be distributed piecemeal ie. This manuals E-books that published today as a guide. The ratio is 2.

The Balance of the purchase consideration was to be discharged by the issue at par of 15000 equity shares of Rs. Partnership dissolutions may take a substantial number of days even months so it is unlikely that all cash generated will be simultaneous unless the business is sold off as a going concern ie. If all the assets are realized immediately on dissolution of the firm then all the liabilities may also be paid off and the partners will receive the amounts due to them on capital accounts at that time.

1 SurplusExcessProportionateQuotient Capital Method. By installments depending on cash received. In such circumstances the choice is.

Piecemeal distribution is when assets are released over a period of time. Our site has the following. Were concerned about the the companys cash flow.

Here is the video about piecemeal distribution under Maximum loss method in dissolution of partnership firm. The figures from January 2016 onward are estimated. This means C receives nothing until the capitals of A and B each are brought down to Rs 56000.

Due to some conflict amongst them the firm was dissolved on 30th June. Piecemeal Realizations and Distributions. Cs Capital 40000 Cash 5000 The partnership is dissolved and the assets are realised as follows.

The directors of Kingston Co. What is the purpose behind adjusting the capitals of partners in their profit sharing ratio in the case of piecemeal distribution of cash. Chapter 2.

Surplus capital method Excess Capital Method Highest Relative Capital. There are two methods to distribute the cash to the partners in piecemeal distribution of cash. Below is a list of the Most Common Procurement Problems we encounter across various organizations Their Solution offering simple ways to fix them.

I The following sales figures are for the months of November 2015 to June 2016. Before using this unit we are encourages you to read this user guide in order for this unit to function properly. In todays business world cost still plays a vital role in consumer products.

10 each credited as fully paid and balance in cash. It is necessary to adjust the capital of the partners to the profit sharing ratio and pay excess contribution to the partners first as and when the cash is realised. Prepare a statement showing distribution of cash as per Excess Capital Method.

As long as the capital contribution ratio and profit sharing ratio of the partners are one and the same the distribution of cash as and when realised does not create any problem when pro-rata distribution is made in accordance with their claim. 1 among A B and C. Cumulative Normal Distribution Calculator and Inverse CDF Calculator For extra practice on material from Chapter 9 or later in McDonald also see the actual.

To watch-----Dissolution of partnership. Meaning of Piecemeal Distribution In dissolution of a Partnership Firm it is assumed that all assets are sold and money is realised on the date of dissolution and at the same time expenses of realisation and all external liabilities. The partners may not be willing to wait for such long durations for the process to be complete.

Study Note 4 4 Page 264 289 Pdf Financial Accounting Balance Sheet

Fillable Online Sarafcollege Piecemeal Distribution Ghanshyamdas Saraf College Of Arts Sarafcollege Fax Email Print Pdffiller

Piecemeal Distribution Of Cash Ghanshyamdas Saraf College Of

Piecemeal Distribution Maximum Loss Method Sum 2 Youtube

Top 25 Problems On Dissolution Of A Partnership Firm

Piecemeal Distribution Of Cash Surplus Capital Method Problem 1 Marathi English Youtube

Piecemeal Distribution Of Cash Ghanshyamdas Saraf College Of

Distribution Of Cash Among Partner

Study Note 4 4 Page 264 289

Piecemeal Distribution Of Cash Surplus Capital Method Problem 3 English Marathi Youtube

Introduction To Piecemeal Distribution Of Cash As Per Surplus Capital Method Youtube

Online Account Reading Dissolution Of Partnership Firm And Piecemeal Distribution

I Multiple Choice Questions Pdf Free Download

Piecemeal Distribution Theory Pdf Debits And Credits Balance Sheet