Position Sizing Calculator Excel - Its impossible to open a position of this size in this market so well round off the received value to the nearest acceptable. What is a Position Size Calculator.

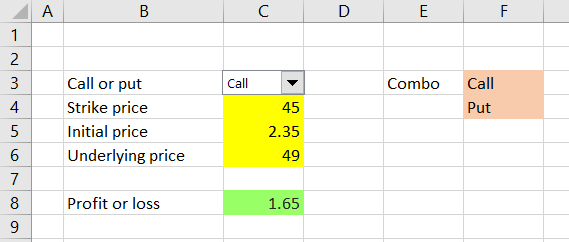

Short Option Payoff And Position Size Macroption

Its 003 of the contract.

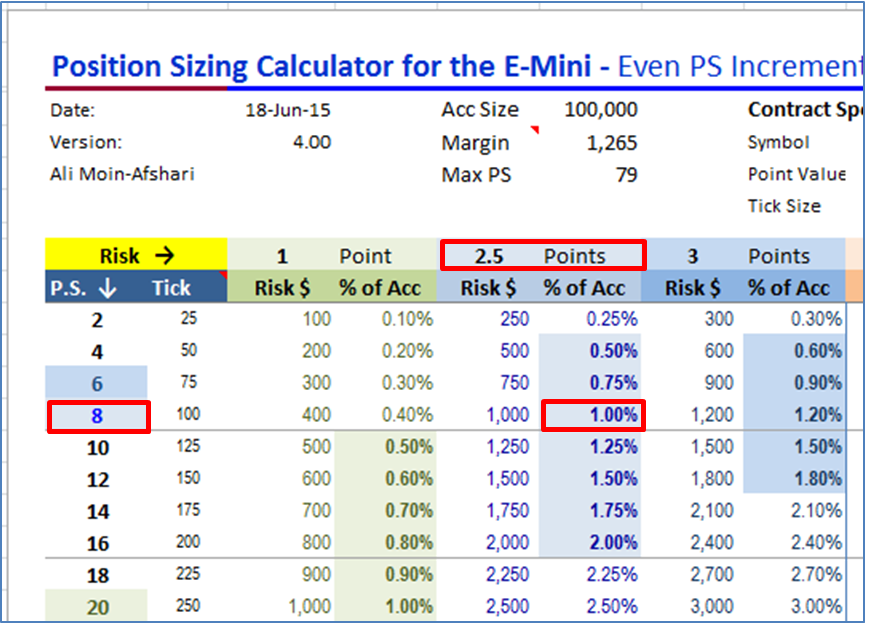

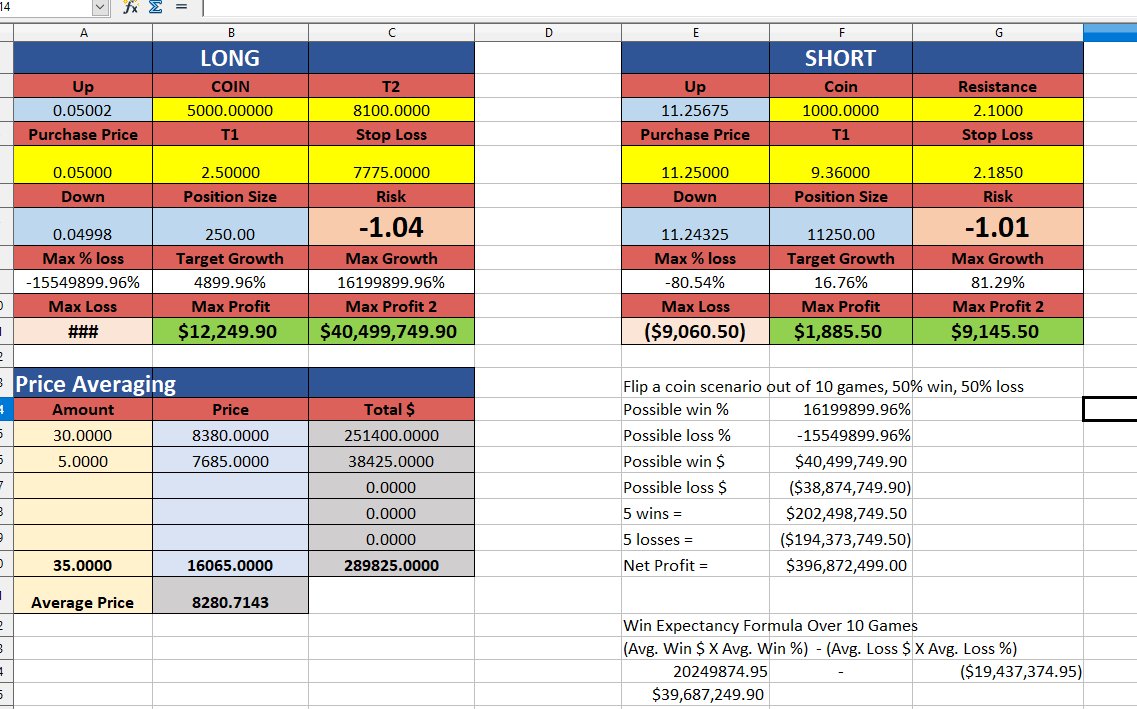

Position sizing calculator excel. IBD Live Position Size Calculator. Total account capital 1000. Simulation and Position Size Calculator Excel.

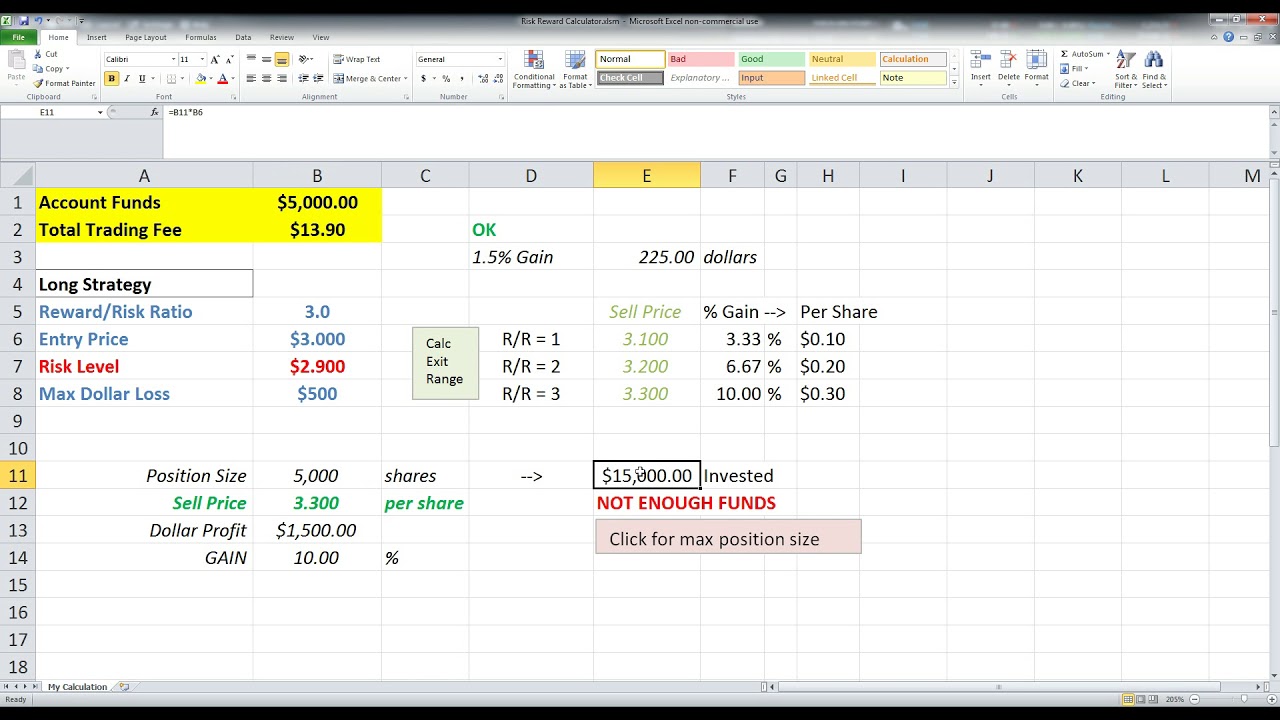

We have an Excel spreadsheet template which does the math for both techniques. Our position size calculator will help you define the proper amount of shares to buy or sell in order to maximize your return and limit your risk. BEFORE entering any trade you should ALWAYS know how much you are going to risk and what your possible reward is going to be.

Position calculator Shares size simulations etc Test your system with this or understand the outcome of probabilities. If the key price support level on your stock is 100 and you buy a stock at 105 you set your stop loss at 100 then you can trade 200 shares with a stop at the 100 price level. Position size 10 coins at 10 100.

200 X 105 21000 position size for 200 shares. Select calculation option if exact value or based on board lot. Risk management calculator will help you find the approximate volume of shares to buy or sell to control your maximum risk per position.

Open the Stock market risk-reward calculation excel sheet. The number of units shows the amount of shares to invest in. Helvetica NeueRegular 2 000000.

To use the spreadsheet first download it and then fill in the yellow cells with the appropriate information. Enter the total capital you have in your account. The CYT position size calculator is a great tool for knowing when to enter when to exit and how much to risk when you are wrong.

Its logical to make money with positive expectancy but in reality there more to it. Enter the brokerage cost per trade from your broker. The middle box of the Position Sizing Tool will help you follow this strategy.

The Position Size Calculator will make managing your forex trade sizes a breeze. One of the most important tools in a traders bag is risk management. First select the portfolio where youll be adding the new position from the dropdown menu at the top of the screen.

100 15 10 coins 85. Position size calculator for risk management and position size management for stock trading be it short term trading swing trading or positional tradingDow. PriceActionTrackers Calculator will help you maximize your return and limit your risk.

The calculator is built primarily for the stock market and helps you buy or sell any stock ETF or mutual fund. Your risk the money you could lose per trade is determined by where you place your stop-loss. Enter your intended account size per trade.

A position size calculator is a handy tool you can use to quickly work out what size trade you should be making for each trade. A stop loss level has to start at the price level that what signal a trade is wrong and work back to position sizing. Then based on the ticker youve entered the calculator will show you how many positions to buy.

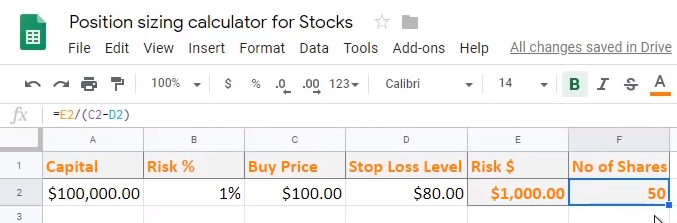

Click this link to download for free. So what youd do is to fill in the following columns in order Your trading capital 100000. Click the image to make it larger.

The following shows what the template looks like. Position Size Share Price Symbol Portfolio Size Total Risk 1-R risk of Shares Gain. This excel calculator will help you find the right position size for you based on your account size leverage and number of trades you want open.

How to use the position sizing calculator for online forex stocks and commodity trading. Retracement Stop Protection Use the button above to export to Excel on your own computer to change any of the variables All numbers can be manipulated such as share price risk stop loss retracement stop protections. As always you can modify the grey cells rest will get calculated by the excel file.

RTD ExcelRTD account number property For example if your account number is 156734 and you want to display the accounts balance. RTD ExcelRTD 156734 balance. You simply need to fill in the account number and the property which you want to display.

Let me explain with an example. How to position size your trades for stocks. The position size appears in the blue cells.

Our position sizing calculator has a simple formula thats time-tested. The equity at risk shows the risk percentage times total investable assets. Because simulation doesnt factor our emotion which is the main reason for losing trades.

Stop-loss level not lower than. The Oxford Club the publisher of Investment U recommends putting no more than 4 of your equity portfolio in any single stock. 15 of capital 0015 1000 15.

The stop price is one minus the trailing stop TS percentage times the entry price. For buying enter the risk and reward ratio greater than 2 in the risk-reward column. With a few simple inputs our position size calculator will help you find the approximate amount of currency units to buy or sell to control your maximum risk per position.

Quick explanation of my riskreward spreadsheet. If you do not understand this. Often these calculators will require you to fill in some information about your account size and the trade you are looking to make for example the pair you are trading and the stop loss size.

Risk Ratio Position Sizing is a MUST to become a profitable trader. Proper position sizing is key to managing risk and to avoid blowing out your account on a single trade. Position size 2000 3 001 211 915 60 193065 00310776.

You need to input your trading account size will change with every trade percentage of risk you want to take per trade will remain fixed depending on your risk profile and your trade plan entry. The Position Size Calculator will calculate the required position size based on your currency pair risk level either in terms of percentage or money and the stop loss in pips. The position value is the number of units times the entry price.

Set a percentage of your account youre willing to risk on each trade. This is a spreadsheet that I have developed myself You can simply just Google stock trading position sizing calculator and you probably can find something similar or even better than this. This file calculates both buying and selling risk and reward and position size.

Allowed risk amount per trade.

Stock Trading Reward Risk Spreadsheet Calculator Youtube

Position Management Help Forex Factory

Position Sizing Calculator Trade Sizing Calculator Excel Spreadshee Priceisking Com

Emini Position Sizing Calculator Brooks Trading Course

Free Download Position Size Calculator Fo Rex Stocks And Commodity Trading Using Microsoft Excel Forex Trading Trading Courses Online Forex Trading

تويتر Philakone على تويتر Have A Position Size Calculator And A Profit R R Calculator If You Don T You Re Doing It Wrong No I M Not Sharing Mine You Can Buy It

Simple Lot Size Calculator Using Excel Only 3 Inputs Forex Factory

Free Download Position Size Calculator Forex Stocks And Commodity Trading Using Microsoft Excel Finance And Trading Made Easy Fatme

Position Size Calculator How To Calculate Your Position Size Youtube

Position Size Calculator Logikfx

Best Forex Position Size Calculator Excel Spreadsheet Template Youtube

7 Stock Risk Management How To Calculate Your Position Size Tradingwithrayner

Position Size Calculators R Stockmarket